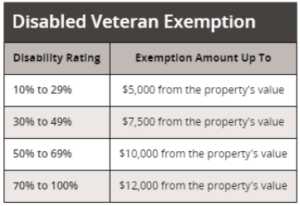

Today, let’s delve into the Texas Veterans Property Tax Exemption for Disabled Veterans – a commendable initiative by the state that brings significant benefits to those who both own property in Texas and receive VA disability. The program operates on a percentage-based system, impacting property taxes accordingly. I’ve simplified the details in a chart for you to easily grasp the nuances.

References: Comptroller.TX.Gov, ” Disabled Veteran and Surviving Spouse Exemptions Frequently Asked Questions”

First and foremost, if you’re rated at 100 percent disability or deemed unemployable, you’re exempt from paying property taxes altogether. That’s right, zero taxes from day one of property ownership. As we move down the disability rating scale (70 to 100 percent, 50 to 69 percent, 30 to 49 percent, and 10 to 29 percent), specific percentages are applied, resulting in corresponding reductions in your tax appraisal. For instance, a 70 percent disability rating translates to a $12,000 deduction from your tax appraisal. To illustrate, if your property appraised at $400,000, your taxable amount becomes $388,000.

It’s essential to also consider two additional exemptions – the homestead exemption and age exemption for those over 65. The homestead exemption applies to your primary residence, and when combined with the disability exemptions, can maximize your overall tax relief.

In conclusion, understanding and leveraging these exemptions can significantly impact the amount you pay in property taxes. So, whether you’re a disabled veteran, over 65, or both, exploring these exemptions can result in substantial savings. I trust this information proves valuable to you. Thank you for taking the time to read!